Make your move easy

with Help to Buy

Help to buy scheme

With ‘Help to Buy’ you could be closer to owning your own V&A Home than you think. The government backed scheme means that you could own yours with as little as a 5% deposit.

Continue

Help to buy scheme

With ‘Help to Buy’ you could be closer to owning your own V&A Home than you think. The government backed scheme means that you could own yours with as little as a 5% deposit.

Continue

So What's Next?

-

Speak to a mortgage advisor

1

Fall in love with a V&A Home. Speak to a mortgage advisor who will be able to help you apply for the Help to Buy Scheme as well as look for suitable lending. We can put you in contact with one if you don’t have your own.

-

Submit Help to Buy application

2

Submit the Help to Buy application. Wait to receive the ‘Ability to Proceed’ document that usually comes through within 4 working days. Once you have received this, you can apply for your mortgage.

-

Instruct a solicitor advisor

3

Instruct a solicitor who will be working on behalf of you, in handling the contracts, the Help to Buy equity loan, and the transferring of deposit and mortgage funds to the seller, which in this case is V&A Homes.

-

Complete the sale

4

On the completion date, all the funds in question will be transferred so that the house can legally become your new family home. At this point, there will be a second charge registered on your home, which entitles Homes England (Government Agency who loaned the Help to Buy loan) to a share of the proceeds of a future sale of your house, or the value after 25 years, whichever comes first.

The percentage paid back to Homes England will be equal to the percentage initially borrowed. If you borrowed 20%, you will need to pay 20% of the sale price of the property at the time of the sale. If you still own the home after 25 years, then you will need to pay 20% of the value of the home at that time.

What is the Help to Buy Scheme?

The Government has launched a new Help to Buy scheme in order to help people who are purchasing their first home to get onto the property ladder.

How does it work:

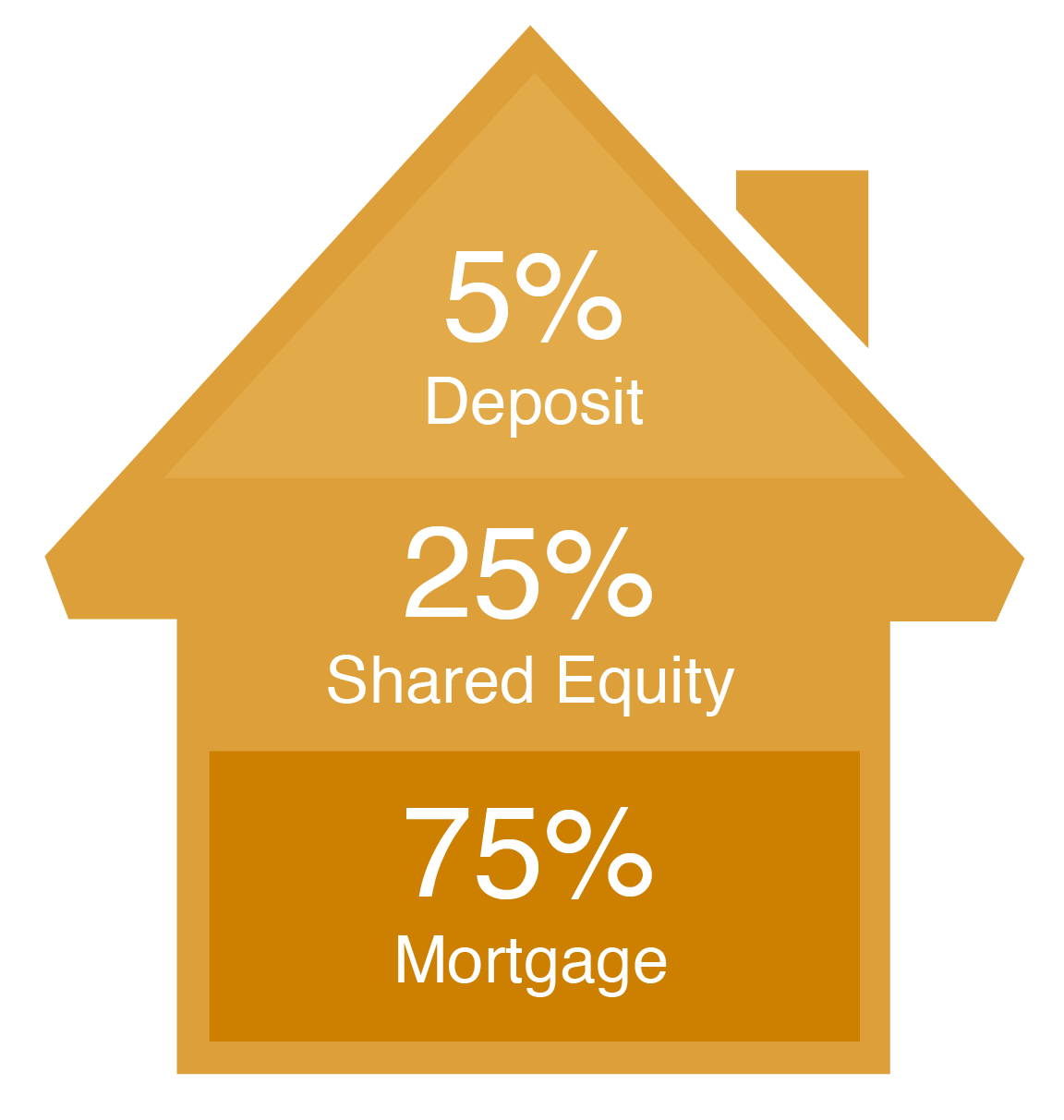

You will need to provide a deposit of 5% of the purchase price.

The Government will lend you up to 20% of the purchase price (this equity loan is interest free for 5 years).

You will then need to arrange a mortgage of 75% to cover the rest of the property purchase.

What do you need to know:

After five years, loan repayments will be charged at 1.75%.

Applications opened in December 2020, but the first homebuyers to benefit from the scheme won’t be able to move in to their property until April 1, 2021.

Under this new scheme, the Government has set regional price caps to reflect average property prices. In Yorkshire and the Humber that means the maximum property price is £228,100 effective between 2021-2023.